Voice based ordering and food tracking devices are believed to be the next big thing to influence the UK’s fast growing food delivery market. This is according to in the latest quarterly GO Technology report from Zonal and CGA, which tracks the technology habits of 5,000 UK consumers.

The GO Technology report indicates that food delivery is booming in the UK, and all the signs are that it will continue to do so.

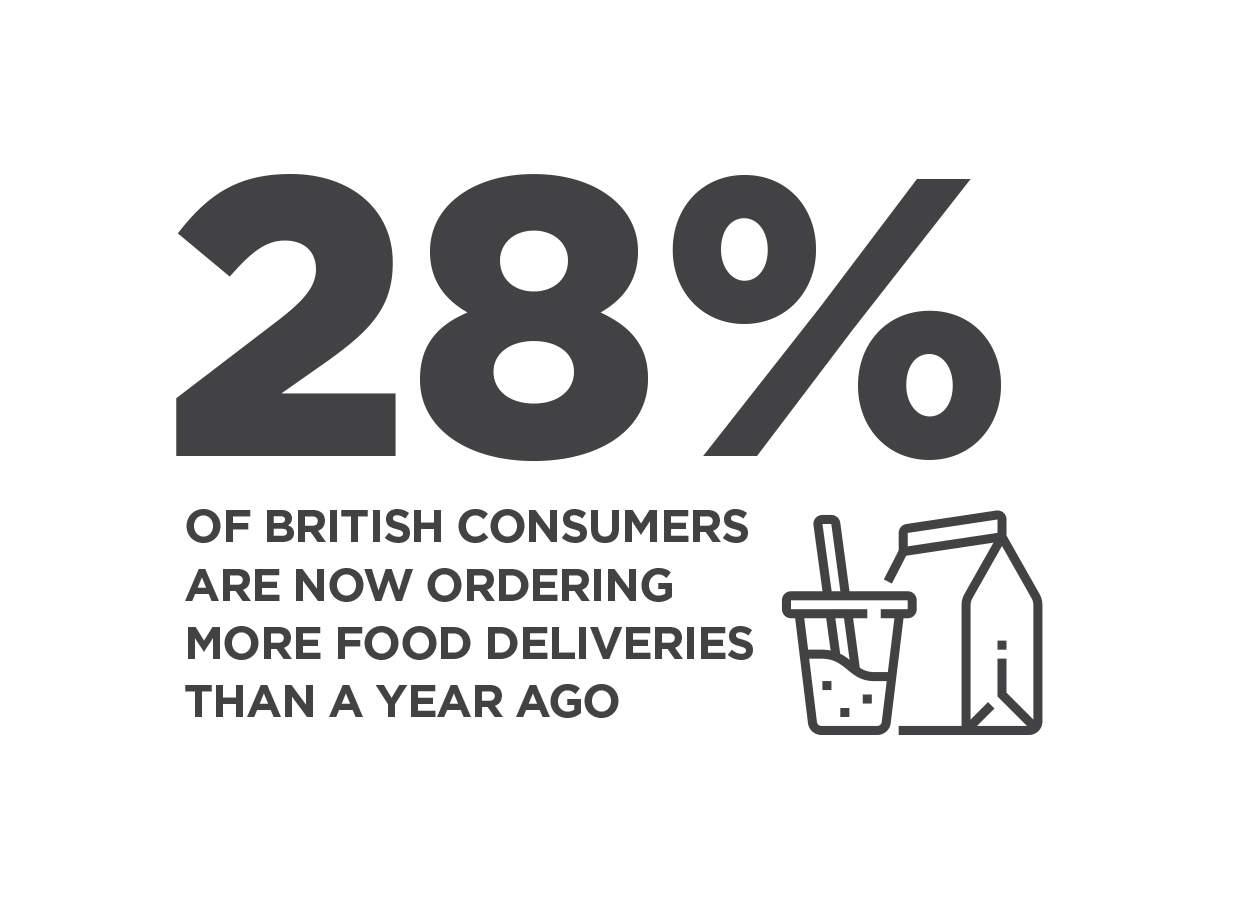

It identifies that 28% of British consumers are now ordering more food deliveries than they did a year ago, with over 27 million orders taken in the last six months, half of which have been made by millennials.

“With people leading busier and more hectic lives, the convenience of getting a delivery straight to the home, office or even hotel has become part of everyday life. Branded restaurants are understandably keen to get in on the action by extending their loyalty beyond the high street and onto people’s tables,” said Zonal’s sales and marketing director, Clive Consterdine.

And driving this trend is technology, with 44% of consumers using online channels to order delivery, with two in five (40%) believing more restaurants will start to offer delivery direct from their own websites, which are seen as the best source of information about delivery. In comparison, only 29% predict a growth in third party mobile delivery apps.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataClive added: “Our latest GO Technology report demonstrates how technology is changing the way we conduct our lives, and the traditional way of doing things has gone out the window. Restaurant brands need to move with the times if they are to stay relevant and popular to demanding consumers, as it seems for many loyalty is being replaced with convenience.

“As this report makes clear, food delivery is here to stay, and it is set to rise in popularity even further. So, with competition on the high street as tough as ever, it pays for restaurant brands to invest in their operational and technology infrastructure now in order to capitalise on the opportunity that home delivery brings to drive additional revenue and meet consumers’ expectations.”

For those brands that get it right the rewards on offer are potentially huge, with 39% of consumers saying they would order more food for delivery if improvements are made to the speed of service and quality of food delivered. Two in five (43%) consumers say they would like to see faster delivery, which puts it at the top of their wish list for improvements, followed by better food temperature (36%) and price (34%).

Karl Chessell, CGA business unit director, retail and food concluded: “Home delivery has changed wholesale in the last few years: firstly, with the advent of ordering platforms such as JustEat, and subsequently with facilitators such as Deliveroo providing a solution that is geared towards the customer and restaurant industry alike.

“But delivery doesn’t come without its challenges. Operators who want to exploit this huge opportunity should do so with the needs of the consumer at the forefront of their minds and invest in the processes and systems that can best serve their customers.

“Building a great service enhances brand equity and offering home delivery can open up a whole new customer base away from the high street. However, poor operational execution will see customers go elsewhere and damage the hard-earned brand reputation across all channels.”