The consumer industry continues to be a hotbed of innovation, with activity driven by taste, environmental sustainability, health and wellness, as well as the growing importance of food safety and transparency, food waste reduction, personalised nutrition, and alternative proteins. In the last three years alone, there have been over 450,000 patents filed and granted in the consumer industry, according to GlobalData’s report on Innovation in Consumer: Cheese substitutes. Buy the report here.

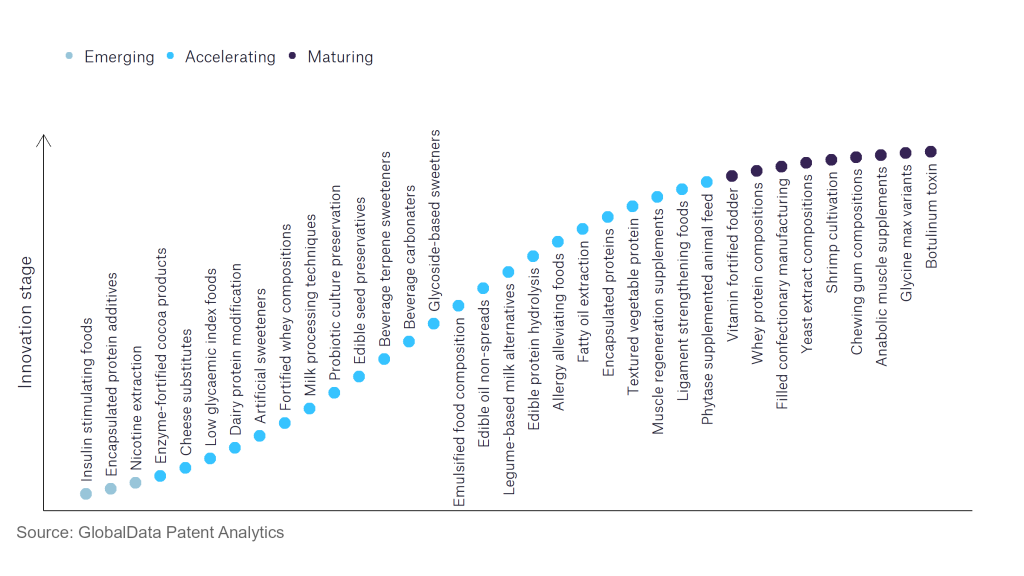

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilising and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

40+ innovations will shape the consumer industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the consumer industry using innovation intensity models built on over 110,000 patents, there are 40+ innovation areas that will shape the future of the industry.

Within the emerging innovation stage, hydrogel dressings, dextrin-based compositions, and encapsulated protein additives are disruptive technologies that are in the early stages of application and should be tracked closely. Artificial sweeteners, milk processing techniques, and emulsified food composition are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas are yeast extract compositions and vitamin fortified fodder, which are now well established in the industry.

Innovation S-curve for the consumer industry

Cheese substitutes is a key innovation area in consumer

Nutritional yeast, a product that is popular among vegans due to its nutty, cheesy flavour, is the most used natural cheese alternative. Being high in protein and B vitamins and low in fat and sodium, nutritional yeast can serve as a healthy cheese alternative.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 10 companies, spanning technology vendors, established consumer companies, and up-and-coming start-ups engaged in the development and application of cheese substitutes.

Key players in cheese substitutes – a disruptive innovation in the consumer industry

‘Application diversity’ measures the number of different applications identified for each relevant patent and broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of different countries each relevant patent is registered in and reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Patent volumes related to cheese substitutes

| Company | Total patents (2021 - 2023) | Premium intelligence on the world's largest companies |

| Chr. Hansen Holding | 36 | Unlock Company Profile |

| Otsuka Holdings | 34 | Unlock Company Profile |

| CJ CheilJedang | 30 | Unlock Company Profile |

| Impossible Foods | 25 | Unlock Company Profile |

| Riken Vitamin | 13 | Unlock Company Profile |

| Savencia | 9 | Unlock Company Profile |

| Fuji Oil Holdings | 7 | Unlock Company Profile |

| Royal DSM | 6 | Unlock Company Profile |

| Valsoia | 5 | Unlock Company Profile |

| House Foods | 5 | Unlock Company Profile |

Source: GlobalData Patent Analytics

Chr. Hansen Holding is one of the leading patent filers in cheese substitutes. Some other key patent filers in the space include Otsuka Holdings, CJ CheilJedang, Impossible Foods, and Riken Vitamin. Recently, Chr. Hansen Holding introduced the new VEGATM Boost culture that is used to produce dairy-free cream cheese. It is allergen-free and has a formulation claiming to provide incredible flavour, good nutrition, sustainability, and affordability.

In terms of application diversity, Chr. Hansen Holding leads the pack. Fuji Oil Holdings and Otsuka Holdings stand in the second and third positions, respectively. By means of geographic reach, Chr. Hansen Holding holds the top position, followed by Otsuka Holdings and Impossible Foods.

As health is becoming a core requirement in food consumption, products such as cheese substitutes are gaining popularity. Not only are they preferred by vegan consumers, but also by some health seekers who are looking to cut down on their calorie/sodium intake.

To further understand the key themes and technologies disrupting the consumer industry, access GlobalData’s latest thematic research report on Consumer.

Data Insights

From

The gold standard of business intelligence.

Blending expert knowledge with cutting-edge technology, GlobalData’s unrivalled proprietary data will enable you to decode what’s happening in your market. You can make better informed decisions and gain a future-proof advantage over your competitors.